EQUITABLE LIFE MEMBERS

DON'T BE FOOLED

The following report was written by a policyholder regarding the changes to the Articles recommended by the Equitable Board.

DON'T BE FOOLED

Have

you ever been out to dinner with a group of people and been stuck with the

bill simply because you’re the last one to leave the table?

That is exactly what the Director’s of Equitable Life are now

trying to do to their most loyal policyholders.

At

the AGM on 28th May, 2003, the Equitable Life Directors will

ask policyholders to approve a Special Resolution 5, to the Society’s

governing Memorandum and Articles of Association (M&AA).

If passed, this amendment will permit the Directors to borrow an

unlimited amount of money or at the very least take on more debt leverage,

by removing the restrictions on the amount of debt that the Society can

borrow. Currently, the M&AA permit the Directors to borrow on

behalf of the Society no more than one-fiftieth of the total funds of the

Society. This restriction was

put into place to avoid placing an excessive debt burden on the shoulders

of only a few policyholders. The

Society already has £350 million in bonds outstanding, issued in 1997

(when assets where growing at £2.7 billion per year[1])

The

problem now facing the Directors is that the number of Policyholders and

the size of the funds are falling rapidly; Policyholders jumped ship at a

rate of £572 million per month in 2002[2].

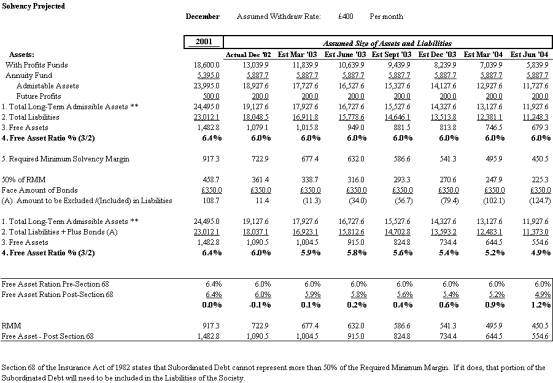

With the assets declining at the current rate, the Society will be

bumping up against its debt limits unless it either repurchases debt or

changes the M&AA (proposed in Special Resolution 5).

By passing this Resolution you will allow the Directors to force an

ever-decreasing pool of loyal policyholders to support the existing debt

burden of the Society. The Society’s total assets at 31 December, 2002 declined to

£19,127.6 million. Once

Assets decline to £17,500 million (i.e. Fifty times debt), the company

will be in breach of its current debt restrictions.

Why

should the Society's most loyal policyholders support the debt burden

taken on by policyholders who have now left the fund?

Who’s going to repay this obligation taken on by prior

policyholders? Who’s

obligation is it?

Why

not collect one-fiftieth (2%) fee from surrendering policyholders to be

held in escrow against the Society debt so the burden does not fall on

remaining policyholders?

Are

the Director’s attempting to sneak this amendment through?

This amendment was not included in a consultation document

previously circulated to policyholders by the Society that purported to

detail proposed changes to the Society’s M&AA.

Don’t

postpone the problem; fix it! The

Equitable Member’s Action Group commissioned a report by industry expert

Cazalet Consulting in December 2002.

The report presses for the Society to become Unit-Linked (“Unitized”)

and spells out potential threat caused by the existing debt at the

Society. The report goes onto

say “it might be in Equitable’s interest to make an offer to

bondholders to redeem the bonds[3]”.

Unless the debt is dealt with, as the Society’s assets decline the debt

becomes a larger component of its capital structure, ultimately hurting

the Society’s solvency. Furthermore,

although the bonds are Subordinated debt, they are ONLY subordinated in

the event of a Winding Up of the Society[4].

A winding up has been completely ruled out by both the Society and

the FSA. Industry experts

agree that due to an accounting treatment of subordinated notes[5] the Society’s debt is

already causing damage to the Society’s Solvency Margin and Free Asset

Ratio and this damage is growing at an accelerating rate.

Don’t

be fooled!

May

20, 2003

[1]

Per Equitable Life Annual Reports and Accounts 1997.

[2]

Per Equitable Life Annual Reports and Accounts 2002 total Gross Claims

in 2002 was £6,864.5 in 2002.

[3]

Per Equitable Life: An Evaluation of the Financial Position of Equitable

Life for The Equitable Members’ Action Group. Cazalet Consulting December 2002, pg 5

[4]

Equitable Life Finance PLC offering memorandum dated 4th

August 1997 pg 6

[5] Section 68 of the Insurance Companies Act 1982 states that subordinated debt cannot represent more than 50% of the Required Minimum Margin.